More Robust Wine Sales Growth in Nielsen Measured Channels

More Robust Wine Sales Growth in Nielsen Measured Channels

Consumers Turn to Big Brands They Know

article originally featured in WineBusiness.com May 6th 2020

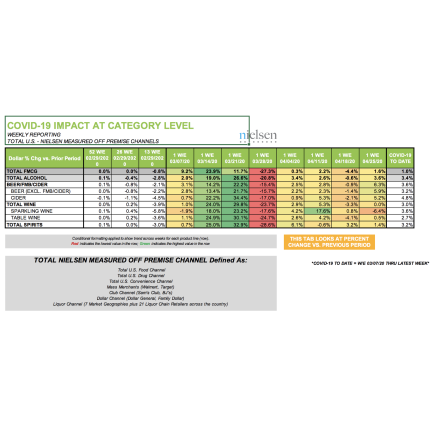

Sales of alcoholic beverages in Nielsen measured channels for the week ending April 25, 2020 were robust, up 26.4 in value compared to the same week during the previous year. The increases from last year were led by spirits, up 40 percent; and wine, up 29 percent; while beer and cider were 20 percent. Nielsen said wine volume growth is now up 27 percent since March 7, 2020, the Covid crisis started affecting sales. "The increase for wine this week was pretty good," Nielsen Beverage Alcohol Practice Senior Vice-President Danny Brager said. "It still says to me that the wine category is doing pretty well." Despite the economic impacts of the crisis, the average price paid at retail off premise across alcoholic beverages continues to increase and is up 2.3 percent for wine.Online sales are up five to six-fold compared to the same period a year ago, Nielsen reported. “This relates to a huge increase in the number of buyers going online to buy, with a secondary increase related to more items purchased per order,” Brager said. Since early March, wines from Oregon and Italy have been leading in growth, and the $20-$25 price segment has led price tier growth in 7 of the last 8 weekly periods measured. “While very small pack sizes may not stand out the most in COVID impacted times, cans continue to grow at about the same rate as pre-COVID, and the 375 ml half bottle is growing at percentage rates 3x higher than pre-COVID, on a relatively small base,” the company reported. The wine brands that have led increases in volume and value in Nielsen tracked channels since early March include Barefoot, Black Box, Bota Box, Franzia, Josh, Stella Rosa, Woodbridge, and Yellow Tail. Brager looked at the 25 brands that have added the most dollars since the COVD crisis began and compared their performance to comparable weeks in 2019. Sixteen of them were not on that same list when he looked at the 25 brands that added the most dollars in the period leading up to COVID (52 w/e Feb 29, 2020 vs year prior), and of those 16, 14 of them are top 25 brands in terms of their rank. He said this suggests there is a consumer set out there that may be learning towards purchasing products that fit one or more of the following buckets:

-bigger, more well known brands

-brands that better fit COVID-19 occasions.. drinking at home, rather than occasions where people might gather or 'on the go' type occasions

-brands that offer a preferred pack size == for example, larger package sizes.

“People seem to be retreating to the big brands that people know."